45 present value of coupon bond

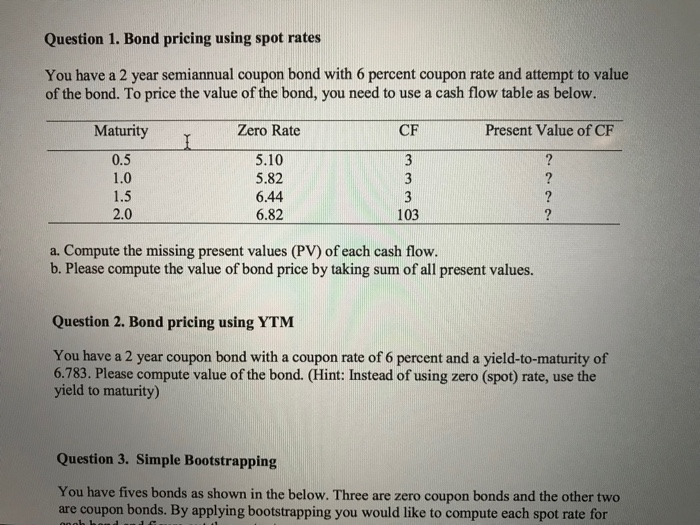

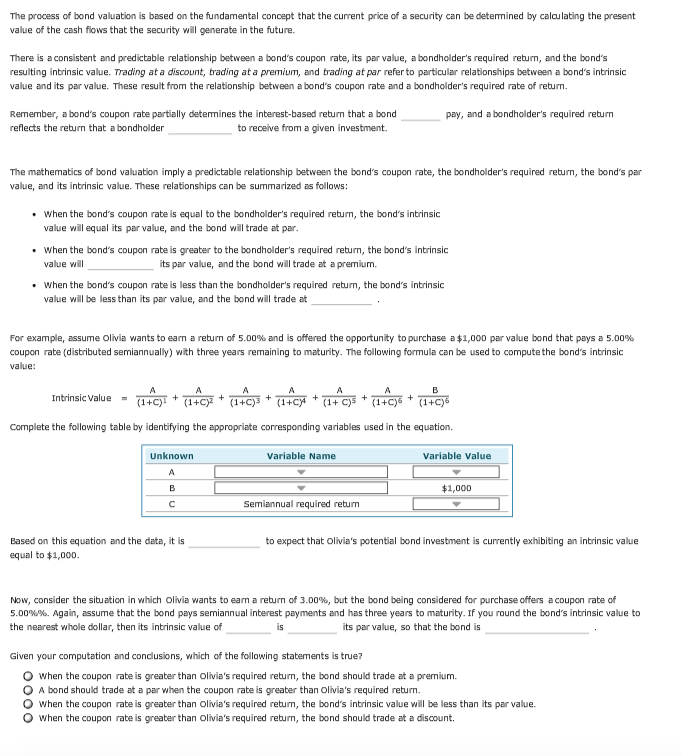

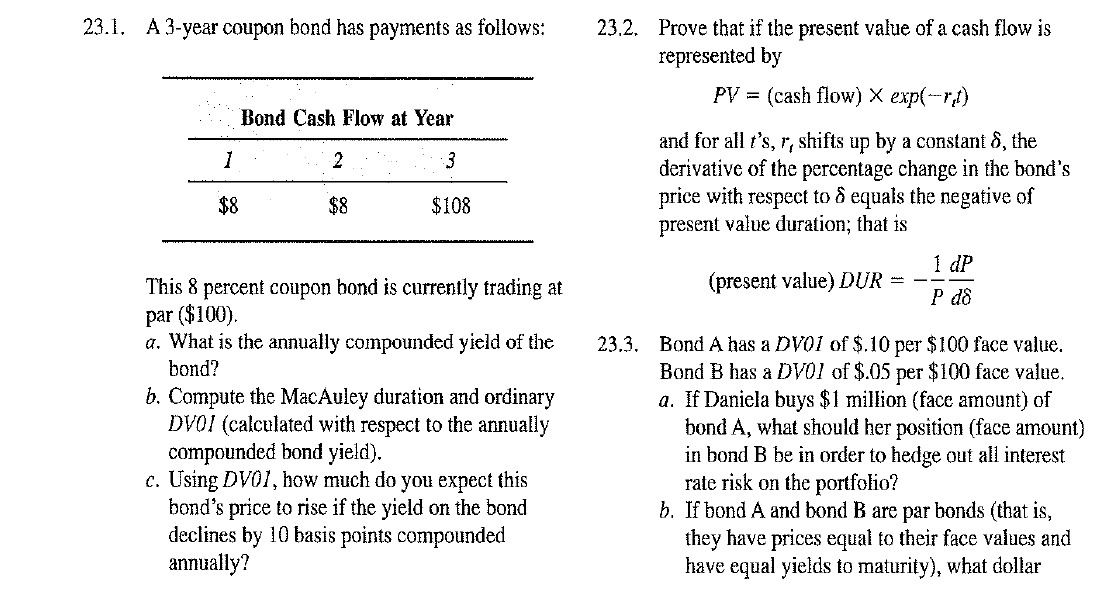

Coupon Rate of a Bond - WallStreetMojo Par value of bond = $1,000 Annual interest payment = 4 * Quarterly interest payment = 4 * $15 = $60 Therefore, the coupon rate of the bond can be calculated using the above formula as, Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount . Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Coupon bond = $40* [ (1- (1+7%/2))^ (-12)) / (7%/2) ] + [$1,000/ (1+7%/2)^12] Coupon Bond = $951.68 Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market.

Solved Consider an annual coupon bond with 4% coupon rate, | Chegg.com See the answer Consider an annual coupon bond with 4% coupon rate, $1,000 face value and 15 year term. Its yield to maturity is 3%. How much of its value is coming from the present value of its face value? Answer in percent rounded to one decimal place. Expert Answer

Present value of coupon bond

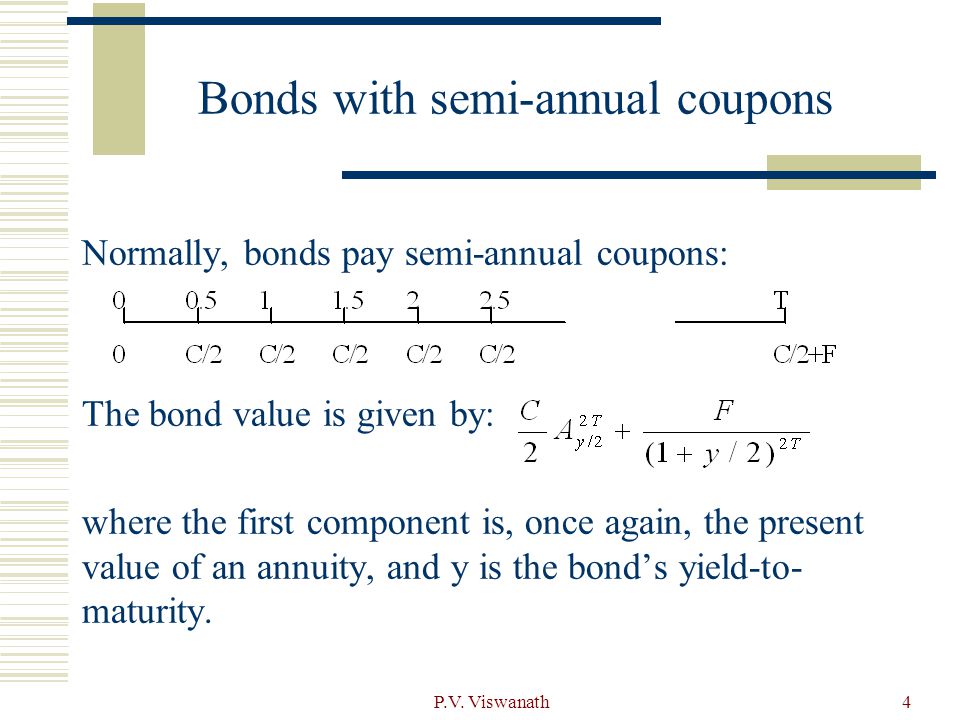

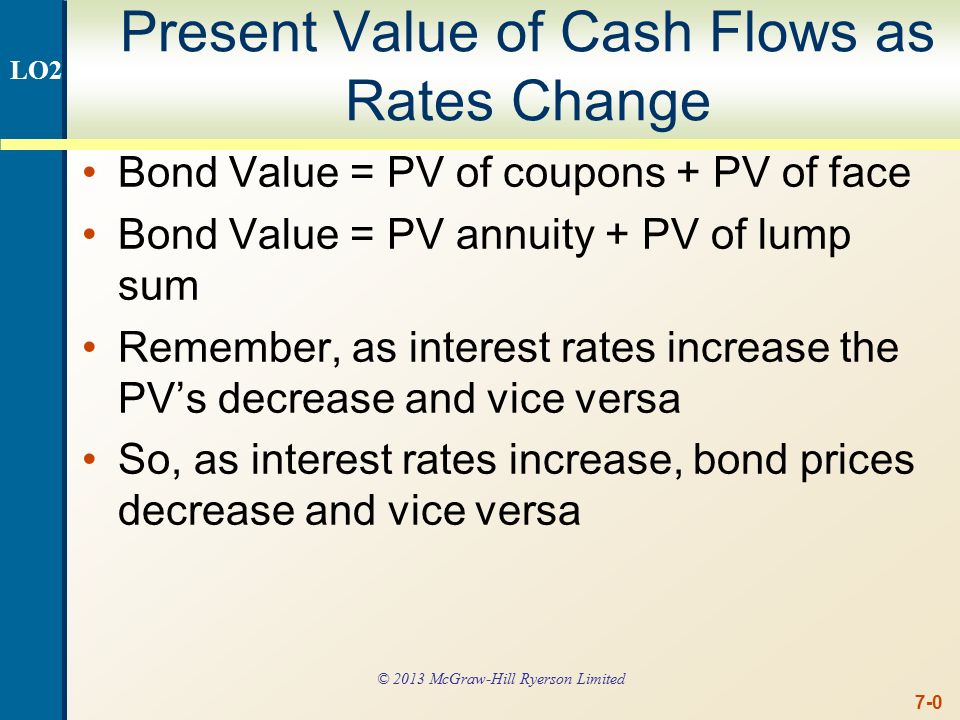

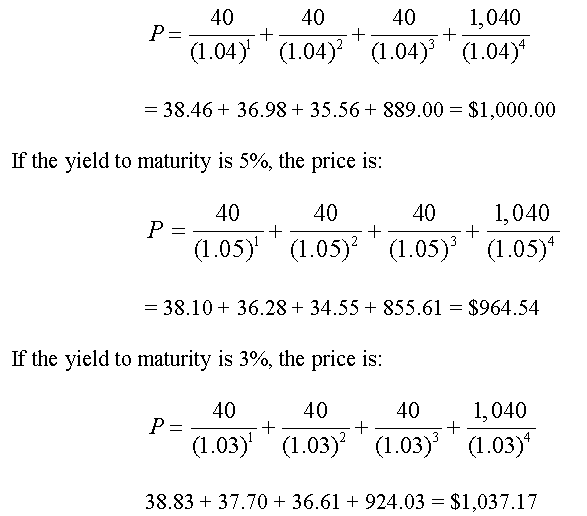

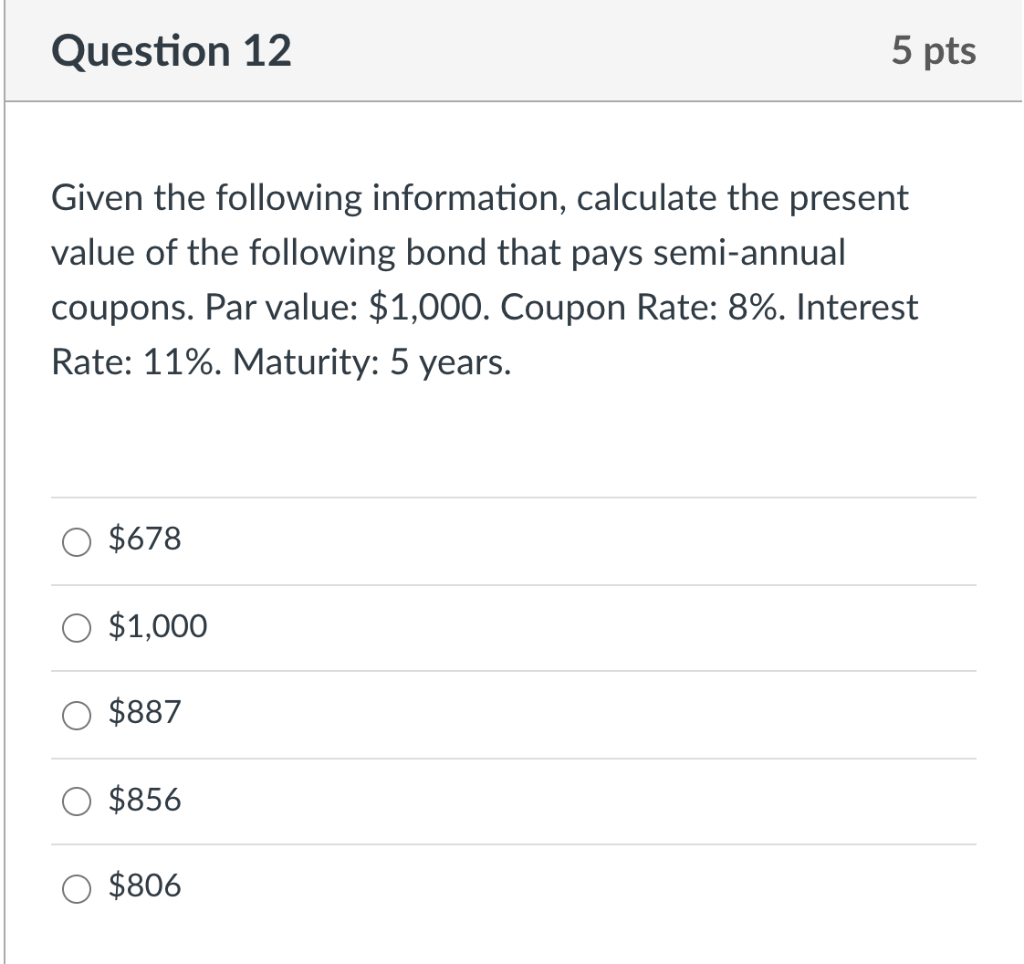

How to Calculate the Price of a Bond With Semiannual Coupon Interest ... Calculating the price of a bond with semiannual coupon payments involves some higher mathematics. Essentially, you'll have to discount future cash flows back to present values. ... Concluding the example, adding the present values of each payment results in a total present value of $964.91. This means the bond's price needs to be $964.91 to ... en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value . Calculating the Present Value of a 9% Bond in an 8% Market The present value of a bond's maturity amount. The present value of the bond in our example is $36,500 + $67,600 = $104,100. The bond's total present value of $104,100 should approximate the bond's market value.

Present value of coupon bond. › retirement › calculatingCalculating Present and Future Value of Annuities - Investopedia Apr 25, 2022 · Here's what you need to know about calculating the present value (PV) or future value (FV) of an annuity. Key Takeaways Recurring payments, such as the rent on an apartment or interest on a bond ... › market-activityStock Market Activity Today & Latest Stock Market Trends - Nasdaq Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq-100, Dow Jones Industrial & more. › terms › pWhat Is Present Value (PV)? - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ... How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%. The investor pays 816 today and receives the face value of the bond (1,000) at the maturity date, as shown in the cash flow diagram below. Zero Coupon Bond Rates

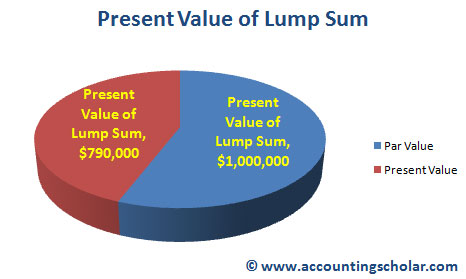

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Bond Valuation - Present Value of a Bond, Par Value, Coupon Payments ... Par Value = $ 1,000 Maturity Date is in 5 years Annual Coupon Payments of $100, which is 10% Market Interest rate of 8% The Present Value of the Coupon Payments ( an annuity) = $399.27 The Present Value of the Par Value ( time value of money ) =$680.58 The Present Value of a Bond = $ 399.27 + $ 680.58 = $1,079.86 Solved The price of a bond is calculated using the present | Chegg.com The price of a bond is calculated using the present value of future cash flows, which includes a coupon payment, C, a par value, Par, number of periods until maturity, n, and a required rate of return, k. When considering the factors that affect bond prices, those that affect an individual required rate of return on the bond, k, are what cause ... Zero-Coupon Bond Primer: What are Zero-Coupon Bonds? - Wall Street Prep Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

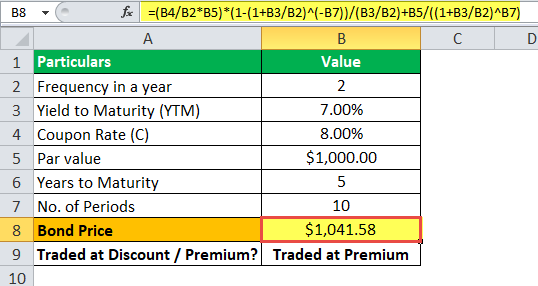

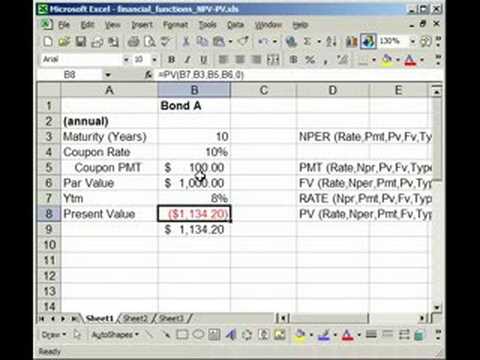

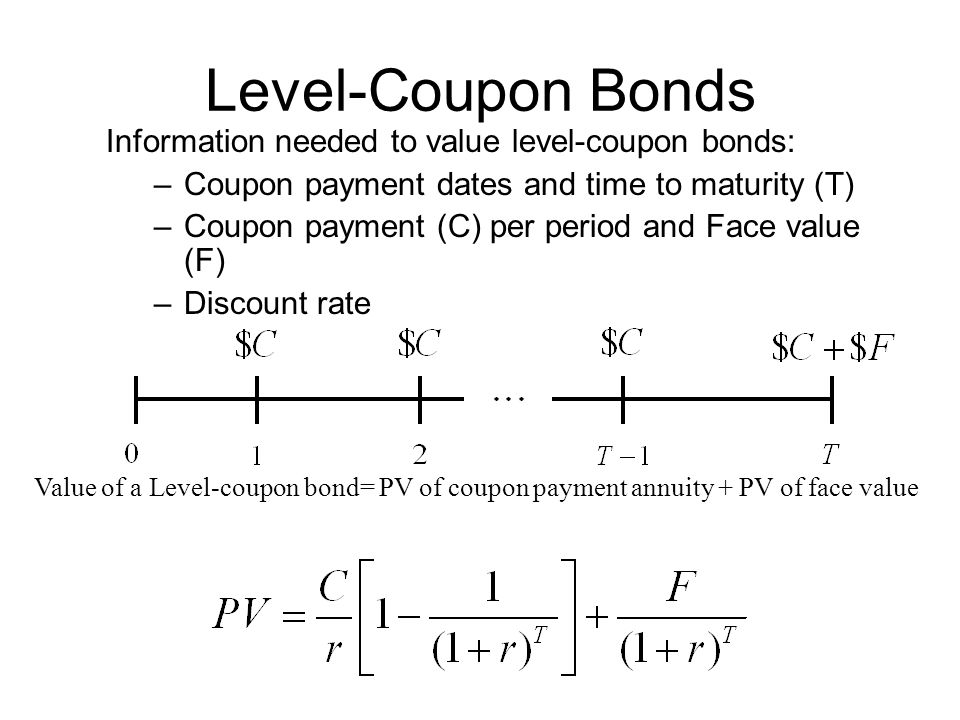

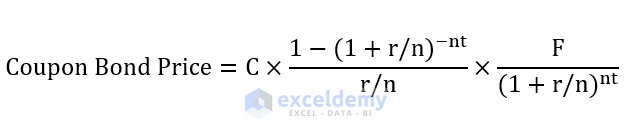

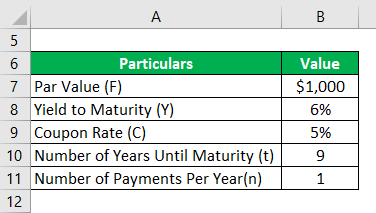

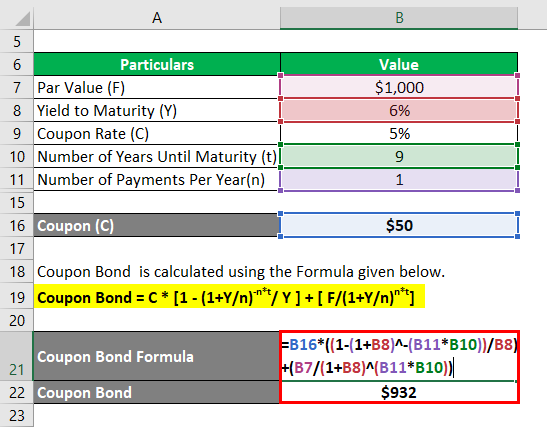

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. How to Calculate Bond Price in Excel (4 Simple Ways) Users can calculate the bond price using the Present Value Method ( PV ). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is 🔄 Coupon Bond Price Calculation Bond Valuation Overview (With Formulas and Examples) To find the bond's present value, we add the present value of the coupon payments and the present value of the bond's face value. Value of bond = present value of coupon payments + present value of face value Value of bond = $92.93 + $888.49 Value of bond = $981.42. A natural question one would ask is, what does this tell me? How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate...

› calculators › bondpresentvalueBond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

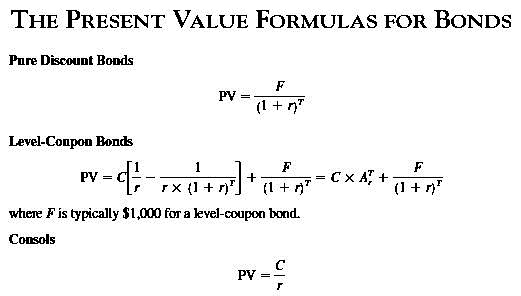

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

en.wikipedia.org › wiki › Net_present_valueNet present value - Wikipedia Observe that as t increases the present value of each cash flow at t decreases. For example, the final incoming cash flow has a future value of 10,000 at t = 12 but has a present value (at t = 0 t = 0 (the present value) at an interest rate of 10% compounded for 12 years, which results in a cash flow of 10,000 at t = 12 (the future value). The ...

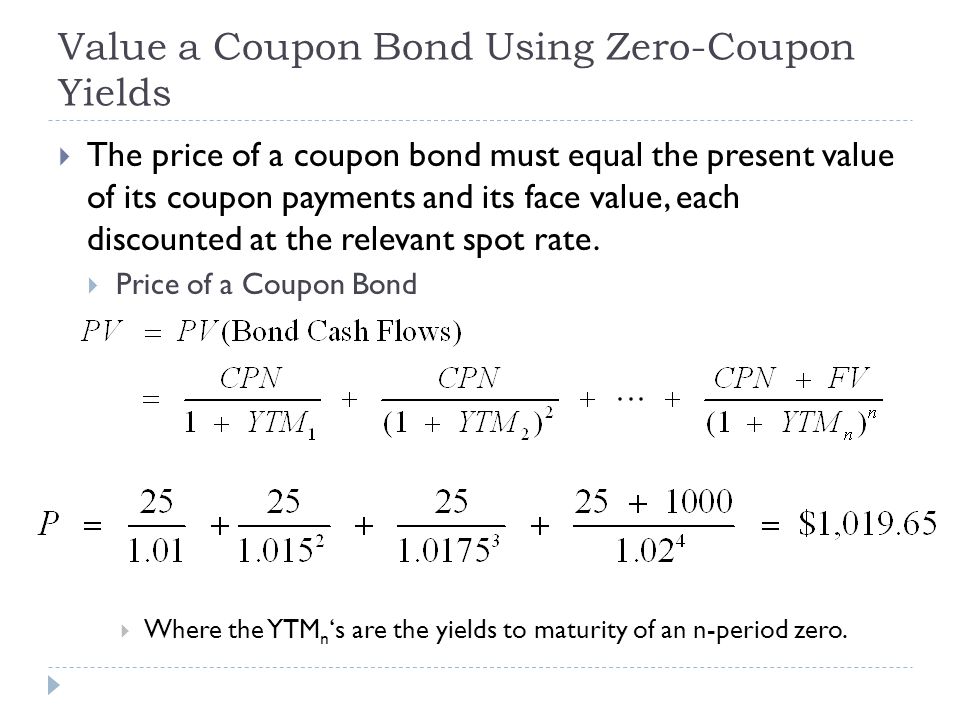

How to Calculate the Price of Coupon Bond? - WallStreetMojo The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n]

Bond Valuation: Calculation, Definition, Formula, and Example Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36 Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the value of the...

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $1,033 Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation The formula for coupon bond can be derived by using the following steps:

Coupon Payment Calculator How to calculate bond coupon payment? Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.

How to Calculate Present Value of a Bond - Pediaa.Com A bond is a financial debt instrument. Calculating present value of a bond involves discounting coupon income based on the market interest rate plus discounting the face value of the bond after the maturity period. This value represents the current value of the future cash flows that will be generated by this instrument. Save

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value.

› communities › northNorth County - The San Diego Union-Tribune Oct 03, 2022 · News from San Diego's North County, covering Oceanside, Escondido, Encinitas, Vista, San Marcos, Solana Beach, Del Mar and Fallbrook.

How to Calculate the Present Value of a Bond | Pocketsense The final period usually coincides with the maturity date. Required Rate (Rate): the interest rate per coupon period demanded by investors. The formula for determining the value of a bond uses each of the four factors, and is expressed as: Bond Present Value = Pmt/ (1+Rate) + Pmt/ (1+Rate) 2 + ... +Pmt/ (1+Rate) Nper + Fv/ (1+Rate) Nper.

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

How to calculate the present value of a bond — AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor.

Consider a coupon bond with a face value \( (F) \) of | Chegg.com Expert Answer. Consider a coupon bond with a face value (F) of $10,000, annual coupon payments 500, and a yield to maturity (i) of 3%. [Hint: it is helpful to use excel for this question.] (a) Calculate the price (present value) of the bond for maturities of one to thirty years. Graph these prices with the bond price on the vertical axis and ...

Calculating the Present Value of a 9% Bond in a 10% Market The present value of a bond's maturity amount. The present value of the 9% 5-year bond that is sold in a 10% market is $96,149 consisting of: $34,749 of present value for the interest payments, PLUS. $61,400 of present value for the maturity amount. The bond's total present value of $96,149 is approximately the bond's market value and issue price.

Zero Coupon Bond Calculator - What is the Market Value? What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Calculating the Present Value of a 9% Bond in an 8% Market The present value of a bond's maturity amount. The present value of the bond in our example is $36,500 + $67,600 = $104,100. The bond's total present value of $104,100 should approximate the bond's market value.

en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value .

How to Calculate the Price of a Bond With Semiannual Coupon Interest ... Calculating the price of a bond with semiannual coupon payments involves some higher mathematics. Essentially, you'll have to discount future cash flows back to present values. ... Concluding the example, adding the present values of each payment results in a total present value of $964.91. This means the bond's price needs to be $964.91 to ...

/bond-valuation_final-17baab1858d741cd88a6e86402933dce.jpg)

Post a Comment for "45 present value of coupon bond"