42 find the coupon rate of a bond

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

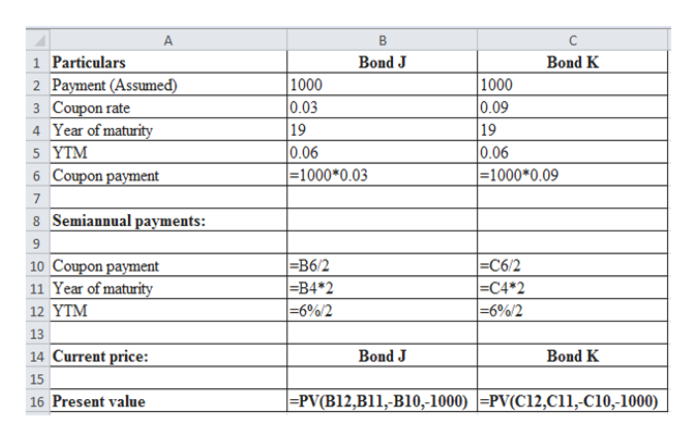

How to Calculate Coupon Rate in Excel (3 Ideal Examples) In this article, we will learn to calculate the coupon rate in Excel.In Microsoft Excel, we can use a basic formula to determine the coupon rate easily.Today, we will discuss 3 ideal examples to explain the coupon rate.Also, we will demonstrate the process to find the coupon bond price in Excel. So, without further delay, let's start the discussion.

Find the coupon rate of a bond

What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year, generally paid on a semiannual basis. How do you calculate the interest rate of a bond? For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. How do you calculate annual interest on a bond? Multiply the bond's face value by the coupon interest rate. For example, if the bond's face value is $1000, and the interest rate is 5%, by multiplying 5% by $1000, you can find out ... Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Find the coupon rate of a bond. How can I calculate a bond's coupon rate in Excel? [ad_1] Most bonds have a clearly acknowledged coupon rate, which is expressed as a proportion. However, calculating the coupon rate utilizing Microsoft Excel is easy if all youhave is the coupon fee quantity and the par worth of the bond. What Is the Coupon Rate? First, a fast definition of phrases. A bond's coupon rate … Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Longer duration bonds are more sensitive to shifts in interest rates. And zero-coupon long duration bonds are more sensitive to rate shifts than bonds which regularly pay interest. Typically the yield curve is upward sloping with longer duration bonds offering a higher return to compensate for the added risk. When shorter duration bonds offer a ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! Bond Coupon Rate Calculator

Zero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73. Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ... Find the coupon rate for an annual coupon bond with | Chegg.com Question: Find the coupon rate for an annual coupon bond with an 8% yield to maturity 3-year maturity and 2.5 years duration Show that for a 2-year coupon bond selling at par with duration D and YTM r, it holds that D=r+2)/ (r+1), what is the implication of this result? Question. Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

What is a Coupon Rate? | Bond Investing | Investment U Calculating a bond's coupon rate comes down to examining its par value and its yield. Specifically, investors would divide the sum of annual interest payments by the par value: Coupon Rate = Total Coupon Payments / Par Value. For example, if a company issues a $1,000 bond with two $25 semi-annual payments, its coupon rate would be $50/$1000 = 5%. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link Bond derivatives - Australian Securities Exchange For each bond in the bond basket, ASX will take the best bid and best offer available in the market by reference to live market prices taken from bond trading venues as determined by the Exchange. Average of the best bid and best offer for each bond will be calculated at 9:00am, 9:45am, 10:30am and 11:15am. Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

What Is a Coupon Rate? How To Calculate Them & What They're Used For Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder.

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

Coupon Bond Formula | Examples with Excel Template Calculate the market price of the bonds based on the given information. Solution: Coupon (C) is calculated using the Formula given below. C = Annual Coupon Rate * F C = 5% * $1000 C = $50 Coupon Bond is calculated using the Formula given below. Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t]

Create function in R to find coupon rate for bond - Stack Overflow Bookmark this question. Show activity on this post. So far, I have written the following function: c_rate <- function (bond_value, par, ttm, y) { t <- seq (1, ttm, 1) pv_factor <- 1 / (1 + y)^t cr <- (bond_value - par / (1+y)^t) / (par*sum (pv_factor)) cr } however, this yields multiple results. How can i update the function to only yield one ...

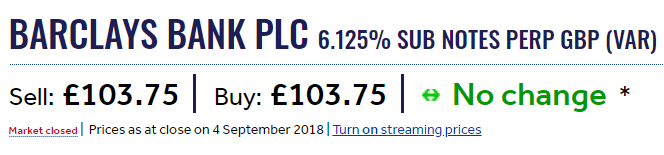

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Bond Price Calculator n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

Coupon Rate Calculator | Bond Coupon Jan 12, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures.

Answered: Calculate Coupon rate.. value par Bond… | bartleby Transcribed Image Text: • Calculate e current band price: Coupon rate. par value rate: 10%. $1000 1 have 12 years cre Bond and payments • Yield to maturity to maturity. Made quaterly. 610 a) $1340 43« c) $2105,80 b) 3893,62 d) $5341,42.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww It is important to understand the advantages of a Zero Coupon bond before opting for this investment. The advantages are mentioned below: No reinvestment risk: Other coupon bonds don’t allow investors to a bond’s cash flow at the same rate as the investment’s required rate of returns. But the Zero Coupon bonds remove the reinvestment risk.

Fixing of coupon rate effective from 1 July 2022 With effect from 1 July 2022, the coupon rate of the following bonds financing RD Euribor3®, RD Stibor3®, RD Stibor3® Green, RD Nibor3®, RD Cibor6®, RD Cibor6® Green and FlexKort® will be ...

How to Calculate a Coupon Payment: 7 Steps (with Pictures) To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency.

How To Find Coupon Rate Of A Bond On Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator.

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

How do you calculate the interest rate of a bond? For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. How do you calculate annual interest on a bond? Multiply the bond's face value by the coupon interest rate. For example, if the bond's face value is $1000, and the interest rate is 5%, by multiplying 5% by $1000, you can find out ...

Post a Comment for "42 find the coupon rate of a bond"